Phillips announced today that they will launch a new tiered buyer’s premium structure by which advance bids (placed over 48 hours before the auction) will have lower fees than those bids placed during the auction or closer to it. Buyer’s premium for non-advance bids in the lowest value tier will be 29%, the highest ever at any of the major auction houses.

The application of preferential fees for advance bidding has a commonality with the principle of the third-party guarantee, by which the guarantor receives a financing fee in exchange for commitment, though financing fees paid to third-party guarantors are negotiable, whereas Phillips’s new tiered BP structure will proceed according to fixed rules.

Auction houses do not publicize whether a guaranteed lot sells to the guarantor or to another party, but since the financing fee paid to the guarantor/successful bidder is reflected in the total amount of buyer’s premium paid (both on the auction house website and on third-party price databases), one can review the hammer price in tandem with the premium price and interpret accordingly.

Similarly, one should expect that Phillips will not publicize whether a lot sells to an advance bidder or to a non-advance bidder. However, when one compares the hammer price with the premium price, one will be able to deduce, for example, by examining whether the latter is 25% or 29% above the former.

Such variances in buyer’s premium underscore the importance for the appraiser of knowing both the hammer price and the premium price. For example, when assessing Marketable Cash Value (MCV), one cannot simply back out a rounded BP from a premium price, because the BP will be subject to fluctuation.

NB: artnet does not publish hammer prices except, occasionally, for lots that do not have reported BP, in which cases they only publish hammer prices.

Fair Warning

Last week Loïc Gouzer announced on social media that his art auction app Fair Warning would no longer submit auction results to Artnet, and that new results will henceforth only be viewable on the Fair Warning platform. He offered no explanation for this decision.

It's important to note the potential disservice that this willful opacity does to the reliability of art market services. While many of us follow the offerings and results of Fair Warning and have general knowledge of what has sold there, it is also reasonable and appropriate to expect that auction sales of significant works of art will be reported on the major third-party price databases such as Artnet and Artprice. Such reporting is part of running an auction venue.

While appraisers and other art market participants frequently have reason to cross-reference auction-house websites for analysis of certain details, it is nonetheless an expectation among us that realized auction prices will be published in the databases to which we subscribe and upon which we rely.

Fair Warning's refusal to submit price results to third-party price databases presents significant risk for errors in valuations. As one example, in November 2024, the all-time auction record for Elizabeth Peyton was set on Fair Warning with the sale of "Blue Liam" for $4,071,000, topping the artist's previous auction record of $2,645,000, also set at Fair Warning, with the sale of "The Age of Innocence" in December 2023. Had these results not been submitted to Artnet, and had someone relied only on the results published in Artnet without assiduously checking Fair Warning's app to see if a Peyton had sold there, that person could have missed the auction record and mistakenly thought that a lower price of $2,470,000 was her all-time record.

This failure to report auction sales results erodes confidence in the art market, and it undermines the one bastion of transparency that we have. Since private sellers have no legal obligation to disclose data about realized sales, we rely on auction data as the major market measure, and we expect it to be transparent and reasonably complete. Fair Warning has only made slightly over 50 sales to date. When their sales history grows, so too will this problem.

One can also consider whether the burden should lie at all on the business model of the auction price databases. As customers we pay significant fees to use their services, and we justifiably expect thorough reporting of results. Should there be any expectation that the price databases collect freely available data from an app like Fair Warning that refuses to report results?

Thank you Cheryl Karim and Ellen Hoener Ross of Gallagher for inviting me to speak this week to your young collector group. It was an honor to lead the group, and it was an exciting moment to do so, at the end of The Art Business Conference day, with so many interesting conversations fresh in mind.

The talk dealt with strategies for starting an art collection and navigating the complexities of buying art at galleries and at auction, and caring for a collection.

Among the issues discussed were: 1. defining the parameters of a collection; 2. factors that might signal potential market growth; 3. the relative advantages of buying art at auction vs. in retail contexts, for different types of work; and 4. assembling the right team to help you with your collection, including but certainly not limited to an advisor, an insurance broker, a framer, an appraiser, and logistics experts.

(l. to r.) Pablo Picasso, Femme hurlant sa douleur, June 1937, Paul Coulon booth; René Magritte, Moralité du sommeil, ca. 1941, Paul Coulon booth; Gustav Klimt, Prince William Nii Nortey Dowuona, 1897, Wienerroither & Kohlbacher booth: all at TEFAF, New York, 2025

Comments in May edition of Artsy Insider newsletter

Thanks to Artsy Art Market Editor Arun Kakar for including my comments in the May edition of the Artsy Insider newsletter, released today. Here’s my contribution:

Artsy: For this month’s mailbag, we spoke to the independent art advisor David Shapiro. Based in New York, Shapiro is also a certified fine art appraiser and specializes in post-war and contemporary art.

How would you characterize the sentiment at this year’s New York Art Week?

DS: While I hesitate to characterize the sentiments of others, some may agree with my observations, which include the following: At Frieze, some galleries appeared to devote less to this fair than to others.

The compression of New York’s fair schedule into a single week highlighted a palpable difference in quality between Frieze and TEFAF, the latter being superior. As to the question of the extent to which larger economic factors may (or may not) be affecting commerce, one rarely knows the true volume of trade and actual extended prices in a retail sales venue.

As such, the more reliable market gauge, as usual, will be the auctions, after which sentiment will be rooted more firmly in fact.

My comments in ARTnews: Bazelon et al v. Pace Gallery

My comments are included in today's ARTnews article about the Bazelon et al v. Pace Gallery case regarding a sculpture whose attribution to Louise Nevelson is in question:

And as New York–based adviser David Shapiro, a certified member of the Appraisers Association of America, put it, “An appraiser’s job is to reflect what’s happening in the market. If we think a work wouldn’t be perceived as authentic, that must factor into the value. And if new information emerges, an appraiser can change their mind—so long as it’s disclosed.”

PRMA: East Coast Private Client Catastrophe Planning Session

It was a pleasure speaking to the East Coast Chapter of PRMA about partial loss-in-value appraisals at the Gallagher offices in New York. Below is a slide from the presentation that summarizes some of the factors that can affect the relative loss in value (LIV) sustained by a work of art that has been damaged.

PRMA, New York Metro Chapter: East Coast Private Client Catastrophe Planning presentation

I will be speaking about partial loss-in-value art appraisals in the Private Risk Management Association (PRMA), New York Metro Chapter's East Coast Private Client Catastrophe Panning presentation on March 19, joining experts in adjacent fields to address this important and timely topic. Sign up here. Full event description below. I look forward to seeing you there!

Please join the NY Metro Chapter of the Private Risk Management Association (PRMA) for an enlightening panel discussion focused on catastrophe planning within the private client insurance sector. This event promises to be an invaluable opportunity for professionals seeking to deepen their understanding of risk management strategies. During the panel discussion, industry leaders will address the unique risks faced on the East Coast and explore key considerations for effectively managing these risks on behalf of our clients.

In addition to the panel discussion, the event will feature a Risk Management Gallery, where subject matter experts will be available to share their insights and expertise on topics such as disaster mitigation, post-loss fine art appraisals, and textile restoration.

We look forward to your participation in what promises to be a highly informative and engaging event.

Space is limited. Please register as soon as possible to guarantee your spot.

We will be providing delicious food and drink for all attendees as well. Hope to see you there!

The NY Metro Chapter Committee Members:

Kurt Thoennessen, CAPI – Arthur J. Gallagher & Co.

Dana Acabbo - Make the Switch Insurance

Mike Smerkanich, CAPI, CPRIA – WTW

Kathleen Atkins – Hub Private Client

Jennifer Brown – Art Peritus

Hannah Noel Brudnicki – Nomadx

Hannah Iversen, CAPI, CPRIA – NFP

Kelley Beach - Marsh McLennan Agency

Alex Horowitz - Berkley One

Michael Kelly - Smith Brothers Insurance, LLC. USA

Kevin F. Madden - Amwins

Chris Martens – Assured Partners

Zyggi Nemzer, CAPI, CPRIA - USI Insurance Services

Phillip Rehg, CPCU, CPRIA - HUB International

David Shapiro – David Shapiro Fine Art

Alison Sweeney – Distinguished Fine Art & Collectibles

Jennifer Najeer – Arthur J. Gallagher & Co.

Jake Dimitro – Fabric Renewal

(l.) George Condo, The Redhead, 2024, acrylic and pastel on paper, 78 × 60 inches; (r.) George Condo, Abstract Male Portrait, 2024, acrylic, pastel, and metallic paint on paper, 80 × 78 inches (both at Hauser & Wirth)

The market for pastels, George Condo and otherwise

In an Artnet News article published on Friday, Katya Kazakina writes about the market for George Condo’s pastels, which are the subject of two concurrent solo shows in New York, at Hauser & Wirth in SoHo, and at Sprüth Magers on the Upper East Side.

As Kazakina reports, the pastels, all variably large in scale, are priced between $600,000 - $1.5 million, mostly at $1.2 million, and are “selling fast.” Kazakina muses: “Was it savvy to focus on works on paper?… Are they a good deal? Will they prove to be good investments?”

She notes, perhaps with a subtext of her now-familiar bearishness that “Condo’s best result for a resold work on paper at auction was for Tan Orgy Improvisation (2005) [illustrated below], which made just over $1 million in 2018.”

While this is true, rather than reach back over six years, one will find a more relevant comparable in the recent sale of a smaller but stylistically closer work, Abstract Face (2) (illustrated below), which fetched $516,600 at Christie’s, New York just over a year ago, on November 10, 2023; the price flew above a high estimate of $350,000. Abstract Face (2) lacks the rich color backgrounds seen in the works presently on view at Hauser & Wirth and Sprüth Magers, and as such, the strong realized price for such a less complex piece further suggests that the current primary-market prices may be a “good deal” and that the works might in fact be re-sold for a profit in a future secondary market.

(l.) George Condo, Tan Orgy Improvisation, 2005, acrylic, oilstick, and pastel on paper, 60.4 x 61.75 inches; (r.) George Condo, Abstract Face (2), 2012, pastel on paper, 30 x 22.5 inches

The works currently on view at Hauser & Wirth and Sprüth Magers are mixed media, with acrylic and pastel. This combination of media can be seen in many Condo works, including Force Field (2010) (illustrated below), which set his auction record, selling for $6,857,413 at Christie’s, Hong Kong (online) on July 10, 2020, at the height of the pandemic. The essential difference in materials between that work and those presently on view at Hauser & Wirth and Sprüth Magers is the support: Force Field is on linen, not on paper like the works currently on view.

(l.) George Condo, Force Field, 2010, acrylic, charcoal, and pastel on linen, 45.6 x 82 inches; (r.) George Condo, Female Gathering, 2024, Acrylic, pastel and metallic paint on paper, 80 x 78 inches

Among drawing media, pastel is frequently regarded as among the most similar to paint, with its pure powdered pigment and minimal binder giving a vibrancy seen in few drawing media. Historically, pastels have sometimes been called “pastel paintings” — without a bit of wet paint.

For some artists, like Nicolas Party (or Rosalba Carriera and others, long before), pastel is the main medium — their painting medium, one might even say. Party’s highest auction sales, by far, are for pastels (though on linen), topped by the sale of Blue Sunset (2018) for $6,667,293 on November 30, 2022, then Still Life (2015) for $4,990,125 on May 28, 2023, both at Christie’s, Hong Kong (both illustrated below).

(l.) Nicolas Party, Blue Sunset, 2018, pastel on linen, 70.9 × 59.1 inches; (r.) Nicolas Party, Still Life, 2015, pastel on linen, 59 × 70.9 inches

When one wonders about the long-term market viability of pastels on paper made by artists who also make oil/acrylic paintings on canvas/linen, one might do best to look further back in time to artists who made both pastels and paintings.

The most compelling example might be Edgar Degas, whose all-time auction record for a two-dimensional work is in fact for a gouache/pastel on paper, Danseuse au repos (ca. 1879) (illustrated below), which sold for $37 million at Sotheby’s, New York on November 3, 2008. [NB: One Degas sculpture has sold for a higher price at auction.]

In fact, the seven highest auction sales of two-dimensional Degas works are works on paper, made partially or wholly with pastel. If a major Degas oil painting were to be offered for sale, it could of course realize a strong price, but to date, the highest realized auction price for a Degas oil is $13.6 million, i.e., slightly over one third the highest realized auction price for a Degas pastel / gouache.

Another such example is Mary Cassatt, whose auction record is also for a mixed-media work on paper that includes pastel. This is Young Lady in a Loge Gazing to Right (ca. 1878-79), which sold for $7,489,000 at Christie's, New York on October 20, 2022, significantly above the high estimate of $5 million, and also above the auction record of $6.2 million for a Cassatt oil painting on canvas.

(l.) Edgar Degas, Danseuse au repos, ca. 1879, gouache and pastel on paper, 23.25 × 25.25 inches; (r.) Mary Cassatt, Young Lady in a Loge Gazing to Right, ca. 1878/79, pastel, gouache, watercolor, and charcoal with metallic paint on paper, 25.25 × 19.9 inches

Wikipedia is not a reliable source

Today I discovered that Wikipedia does not have a page on “art appraisal.” They do have one on "art valuation,” though its contents, perhaps not surprisingly, are stilted.

In the first paragraph, its author-less voice proclaims that art valuation “is more of a financial rather than an aesthetic concern” — as if our financial valuations of art are not defined by well-honed “aesthetic concern,” usually over decades. The reader is then informed that our “subjective views” play a part as well, when in fact we are compelled by USPAP to perform our valuations in an independent, impartial, and objective manner. [NB: Opinions of value may vary (even significantly) even among seasoned appraisers, but any USPAP-compliant appraiser is bound to perform valuation services in this manner.]

Also worth adding, there is no Wikipedia page on the Appraisers Association of America, the premier association of personal property appraisers who focus on fine and decorative arts. There are two other major associations of appraisers, namely the International Association of Appraisers (ISA), which is also not represented on Wikipedia, and the American Society of Appraisers, which is represented by a brief Wikipedia page with no mention of art appraisal.

Why should we care? We all know that Wikipedia is not a reliable source, and we yet we all use it to some varying degree for expediency, trying to block out how fundamentally flawed it is. Misrepresentations and omissions of content are already a problem when it comes to personal consumption of information, but the problem is now compounded in the age of AI, which scrapes from all corners of the Internet, including Wikipedia.

What if you asked your AI tool how art is valued? What if it scraped that page, and then you used it in a professional capacity? What if you asked it who the people are who make their living by valuing art?

There are clearly vastly larger problems on Wikipedia with regard to bias, misrepresentation, and exclusion, but this is my corner of the world, so it is my example to highlight with respect to the potential for promulgation of misinformation. Yes, we should edit Wikipedia to rectify this tiny injustice, but the larger principle will remain that today, with AI scraping Wikipedia, it is nothing short of an echo chamber of unattributed statements, many of which are plainly wrong.

The Winter Show / Truth in Pricing

The Winter Show is up now at the Park Avenue Armory, and thank you Chubb for hosting the party last night. Many things can be said about the Winter Show: Not least, it is the best American-run (mostly) pre-modern art fair, spanning a formidable 10 days, with events that initiate the post-Holidays social calendar in New York. Where else can you shop for a 19th-century weathervane, an 18th-century Peruvian Baroque painting, a mahogany settee, and an Egon Schiele drawing all under one roof?

The Winter Show is also a rare example of a fair where many galleries abide by New York City's "Truth in Pricing Law" (NYC Admin. Code §20-708), which specifies that "all consumer commodities, sold, exposed for sale or offered for sale at retail...shall have conspicuously displayed, at the point of exposure or offering for sale, the total selling price exclusive of tax by means of (a) a stamp, tag or label attached to the site, or (b) by a sign at the point of display which indicates the item to which the price refers, provided that this information is plainly visible at the point of display for sale of the items so indicated."

At a contemporary art fair, you will not see such display of prices on the wall labels, with the lone exception of Michael Rosenfeld Gallery. You may never see it at a reputable gallery selling in the primary market. In fact, at many galleries, when you ask at the desk for a price list, you may be told that there is no price list, and that a director can possibly be summoned, at which point you may in fact be told that the gallery is "taking interest."

You can tell the gallery that New York City has a "Truth in Pricing" law that requires conspicuous disclosure of asking prices to the public in the manner stated above. This is not about legal conformity for its own sake. Market transparency is in the best interest of our greater community, and as such, the galleries at the Winter Show that do so are to be commended for it.

Magritte and the Market for Masterpieces

In his January 2025 market recap in the Art Newspaper, Scott Reyburn called René Magritte’s L’empire des lumières, which sold for $121.6 million at Christie’s, the “one out-and-out masterpiece on offer in New York” in the November sales. Reyburn’s comment might be correct if his words were to be edited a bit: The Magritte was the one out-and-out masterpiece in the stratospheric market for highest-end trophies.

But the concept of a masterpiece should be understood as something that is exceptional within its own context. On the same date that the Magritte sold for $121.6 million, by far an all-time record for the artist, a record was also shattered at Christie’s for a Magritte work on paper (of the same title and subject as the painting); which fetched $18.8 million, over double its high estimate. This too could be considered a masterpiece within the context of his works on paper. On the same date, the second highest price for a Magritte work on paper was realized as well.

Sales such as these complicate the narrative of decline that many art market writers have used as a journalistic framework – and such press may even serve a self-fulfilling prophecy, scaring both prospective sellers and prospective buyers, as I have witnessed firsthand.

Without question there has been contraction in some markets in the past two years (e.g., as for many emerging artists), but in a truly recessionary period (or “slump” in Reyburn’s words), sales such as these simply would not be taking place.

One has to wonder, furthermore, what Reyburn has in mind when he says of the $121.6 million Magritte:

“[G]iven that this world-famous image was billed by the auction house as the greatest Surrealist painting to have ever appeared on the auction market, should it have made more?”

The Magritte sold for a price far higher than that of any Surrealist painting at auction or, to the best of my knowledge, any marketplace. It is hard to imagine how much more the painting could have realized on another date – and what that date might have been, given the obvious present taste for Surrealism, which could also be seen in the record-shattering top two sales of Leonora Carrington at Sotheby’s in 2024, including Les Distractions de Dagobert (1945), which made over $28 million in May.

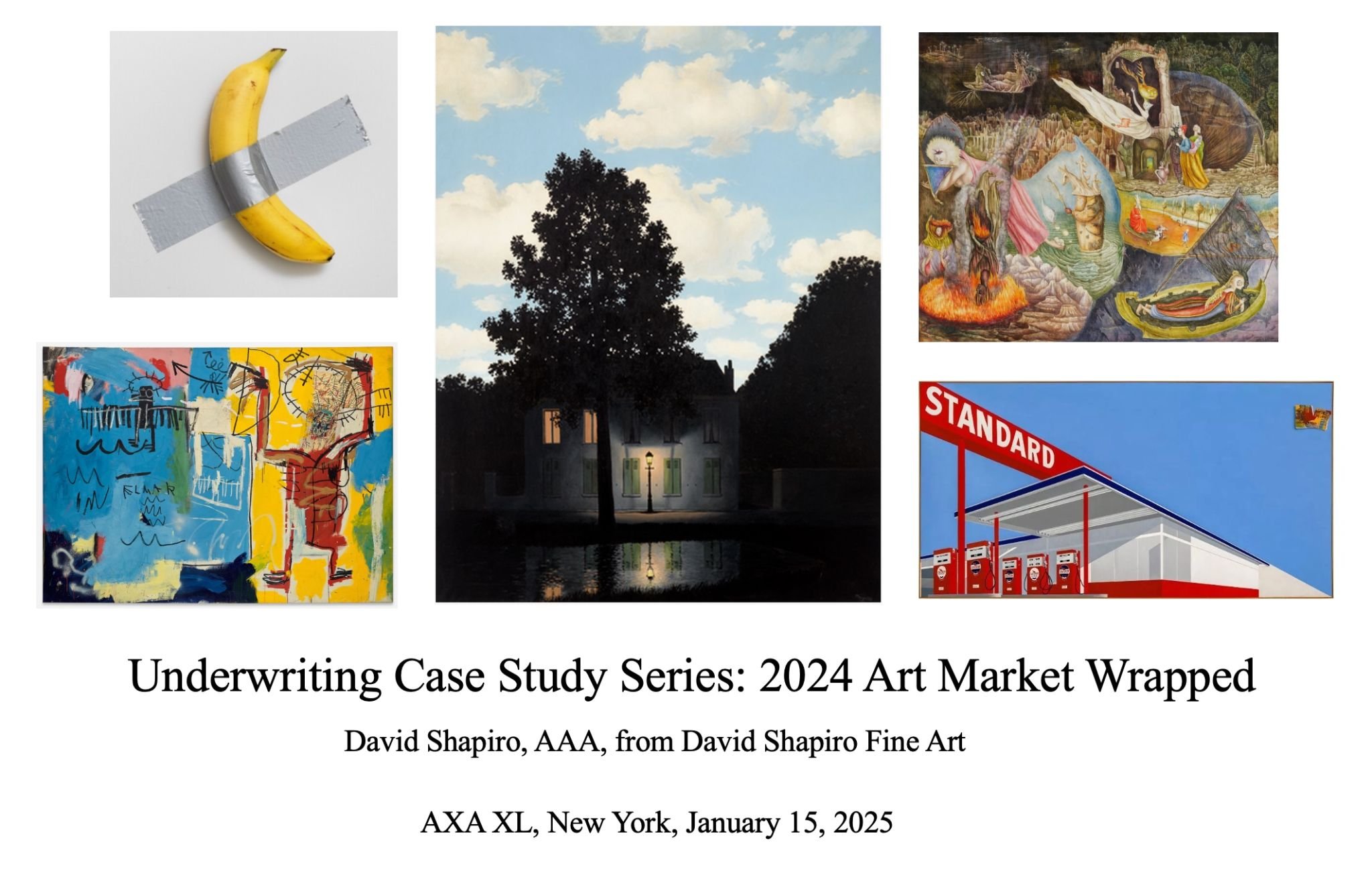

AXA XL: Underwriting Case Study Series

This week I had the pleasure and honor to present a 2024 art market recap to underwriters at AXA XL Insurance.

Finishing 2024, statistics of decline could be seen everywhere, particularly when comparing overall year-to-year sales totals (i.e., 2024 with 2023 and especially 2022), and yet the overall picture is a more nuanced one. Broadly speaking, my presentation complicated the overarching correction narratives that have prevailed in the press.

Fluctuations in supply, particularly at the highest end, often depend on circumstantial factors such as the availability of major estates. As such, any comparison to 2022 will be skewed by the Paul Allen auction (especially) and the Ammann sale.

The failure of any lot to sell at auction for over $50 million in the first half of 2024 did look paltry given the offerings in the immediate past, but in the second half of the year, the three highest lots at auction totaled $255.4 million, over double the total of the three highest lots sold in the first half of the year.

The price realized for the Magritte alone ($121.6 million) was similar to the total of the prices realized for the three highest lots sold during the first half of the year, and the fact that it sold for over $25 million more than a confident estimate (with guarantee) suggests that present demand is strong in the market for highest-end masterpieces, when in fact there is supply.

As such, when Zachary Small asked in a doom-and-gloom article on November 2, 2023, whether the art market “will need to discount its masterpieces,” the answer seems to be a resounding, “NO” – at least not at the high end of the markets.

In 2024, collectors chased high-end non-art masterpieces as well, such as the stegosaurus skeleton, Dorothy’s ruby slippers, and Babe Ruth’s “called shot” jersey, which respectively shattered auction records for fossils, movie memorabilia, and sports memorabilia, collectively underscoring the expansive cross-sector outlook of the trophy market at present.

Other markets, however, were indeed cooler. The middle market remained artist-specific, with a continued trend toward selectivity for some artists. And in 2024, the market for many emerging artists fully collapsed, following a moment of rapid speculation-oriented growth in the covid period.

Also addressed in my 2024 market recap were notable developments such as:

The reuturn of the acceptance of cryptocurrency as payment for auction lots, by Sotheby’s for Cattelan’s Comedian.

The seismic security breach that took place in May when Christie’s website was hacked, making it inoperable during the marquee sale week.

Sotheby’s overhaul and subsequent reversal (less than a year later) of their fee structure, both for buyers and for sellers. The implications of this are also covered in my recent contribution for Artnews.

My 2025 Predictions in ARTnews

I am pleased to have my comments included in ARTnews today in the column "Art World Insiders Make Their New Year's Predictions for 2025":

David Shapiro, New York-based art appraiser and advisor: I see four trends from 2024 that may have an outsized impact on 2025. Firstly, the present strength in the equities market could cut both ways. Investors’ increased purchasing power could promote a turn away from the tentative market of 2023 and 2024, even with high interest rates. On the other hand, the strong performance of traditional investment vehicles could cause trepidation among some prospective buyers who had been more eager to collect art when equities markets were not performing well.

Secondly, the total of the three highest auction lots in the second half of 2024 was over double the total of three highest auction lots in the first half of 2024. Supply permitting, we should expect to see the continuation of this more expansive high end of the market. Christie’s record-shattering sale of René Magritte’s L’empire des lumières (1954) for $121.6 million, which was more than $25 million above an already confident estimate with a guarantee, suggests that we can expect to see competition and consequently strong prices in 2025 when truly significant works are offered for sale.

Thirdly, in 2024, extraordinary prices were paid for major non-art objects, shattering all-time records for fossils, movie memorabilia, and sports memorabilia. In 2025, we should continue to see a cross-sector approach to collecting at the highest levels.

And, lastly, Sotheby’s recent reversal of their dramatically overhauled fee structure, to be effected in February 2025 less than a year after implementation, will make the house more competitive again, particularly for day sale consignments. It should also, in turn, promote healthy competition on the part of the other major auction houses to secure consignments that they might have won more easily when Sotheby’s non-negotiable terms were so unfavorable to sellers in the latter part of 2024.

Auction estimate vs. appraisal

Perhaps I'm not the only one to have done a double take at Sotheby's loose language in their Instagram ad fed to me (and you?) today.

As Sotheby's should know perhaps as well as anyone, an auction estimate is not an appraisal. An auction estimate is a strategic figure designed to optimize results within a specific auction sale context.

An appraisal, by contrast, is an opinion of value (or, per USPAP, the act or process of developing such an opinion of value.). Depending on the type of value being appraised and the effective date of valuation used in an appraisal, and also depending on the specific auction sale context for a given estimate, an appraisal and an auction estimate for the same item may be similar -- or in many cases, they will differ significantly.

Sotheby's auction estimate for a work may be far higher than the estimate that a small auction house in the Midwest might give for the same work -- and both might be informed, accurate reflections of how best to market that item within their respective sale. These are not appraisals but rather context-bound marketing figures that reflect auction house perceptions of a specific market.

Duchamp, Koons, and Cattelan

Yesterday, Scott Lynn of Masterworks posted an article to LinkedIn titled “Why We Think Maurizio Cattelan’s $6.2M Banana Might Not Be a Smart Investment. Although I agree that one cannot necessarily expect "Comedian" to continue to appreciate (and certainly not at the same exponential rate that it has the past few years), I think that some of his logic and substantiation is worthy of critique (especially No. 3).

1. Lynn says that “market trends don’t favor Cattelan’s work.” He cites an 80% decrease in total auction sales prices of Cattelan since 2010, “signaling that his broader market trajectory is declining.”

However, one must be cautions not to assess an artist’s overall market simply by tracing relative annual sales results, which depend in no small part on the content of the consignments. For example, nothing like "Him," Cattelan’s sculpture of Hitler, which fetched $17,189,000 at Christie’s, New York in 2016, has been offered publicly for sale. If it were, one should expect a strong price, perhaps particularly in the wave of the current spectacle surrounding the artist.

2. Lynn states that “conceptual art has limited market appeal.” While I don’t necessarily disagree that conceptual art presents certain marketing challenges relative to traditional physical art, Lynn’s generalized statement may not apply to a particular and truly iconic work, which indeed, “Comedian” became, practically the minute it was first exhibited at Perrotin’s booth at Art Basel Miami Beach in 2018. Exceptional works do not necessarily conform to generalized rules.

In an attempt to substantiate the claim that "conceptual art has limited market appeal," Lynn cites a 1999 sale of Duchamp's "Fountain" (i.e., readymade urinal) for $1.6 million. However, Lynn (of all people) should know that the markets for modern and contemporary art have transformed fundamentally in the past quarter century. If "Fountain" were to be offered today and marketed as deftly as “Comedian” was by Sotheby’s, I have no doubt that it would be estimated at, and sell for a much stronger price than it did in 1999.

3. Lynn says that “editions could dilute value.” Here, in reference to “Comedian”, which is an edition of 3 + artist’s proofs, I emphatically disagree. Of course, a print from an edition of 50 will almost certainly be significantly less valuable than a unique work by the artist. This, however, is not the case for many small editions, such as those of certain sculptures.

The best example to demonstrate this point my be Jeff Koons's "Rabbit", which sold for $91.1 million at Christie's, New York in May 2019. This remains the highest auction price realized for a living artist. It is from an edition of 3 +1 artist's proof.

One might even surmise that in certain circumstances such as that of "Rabbit", the distinguished collections of the other editions can propel the price that prospective collectors are willing to pay for the rare available edition. Similarly, if another edition of "Comedian" were to be offered for sale, the spectacle of the edition sold at Sotheby’s last month may add to interest.