My comments are included in Bloomberg Law today, in Angélica Serrano-Román's article, "Bourbon, Monet, and Tax Credits Find a Niche Market in Bankruptcy" (link below). This is the passage:

Most recently, a Claude Monet ‘Water Lilies’ painting from the collection of bankrupt hedge fund manager George Weiss showed up on Inforuptcy, a subscription website for professionals and distressed-asset investors that scans court documents and sale motions from the government’s online docket system and converts them into listings. Think Craigslist, only for bankruptcy assets. [...]

It lacks the complexity seen in Monet’s more significant later paintings of ‘Water Lilies,’ said David Shapiro, an art adviser with experience appraising the collection of the Detroit Institute of Arts. They have richer color and “are more resolved paintings, with this painting looking more sketch-like by comparison,” he said.

As of late November, nine Monet paintings of ‘Water Lilies’ have sold at public auctions for more than $50 million, including buyer’s premium, he added.

The bankruptcy court ultimately approved the sale of Weiss’s Monet in October for $36.5 million. There were no competing bids after another deal fell through, when a potential buyer couldn’t secure funding.

The art world has crossed into bankruptcy before, most notably through Detroit’s “Grand Bargain,” launched to prohibit the sale of works from the then city-owned art institute to pay off debt and to help raise funds to protect pensions in 2014. [...]

PRMA blog post: The Art Market Is Moving Fast: Here’s Why Appraisals and Insurance Matter More Than Ever

Following my recent webinar, Private Risk Management Association (PRMA) summarized the program in a blog post, "The Art Market is Moving Fast: Here's Why Appraisals and Insurance Matter More Than Ever".

Their blog post covers topics in the presentation including:

-- A market of extremes

--The rise and fall of emerging artists

--The risk of underinsurance

--Appraisal standards

--The expanding world of collectibles

--The benefits of staying proactive

Drawing from the webinar, PRMA has also assembled an Art Market Volatility Watchlist, alerting brokers, underwriters, collectors, and their advisors to some key points regarding shifting values in the present market.

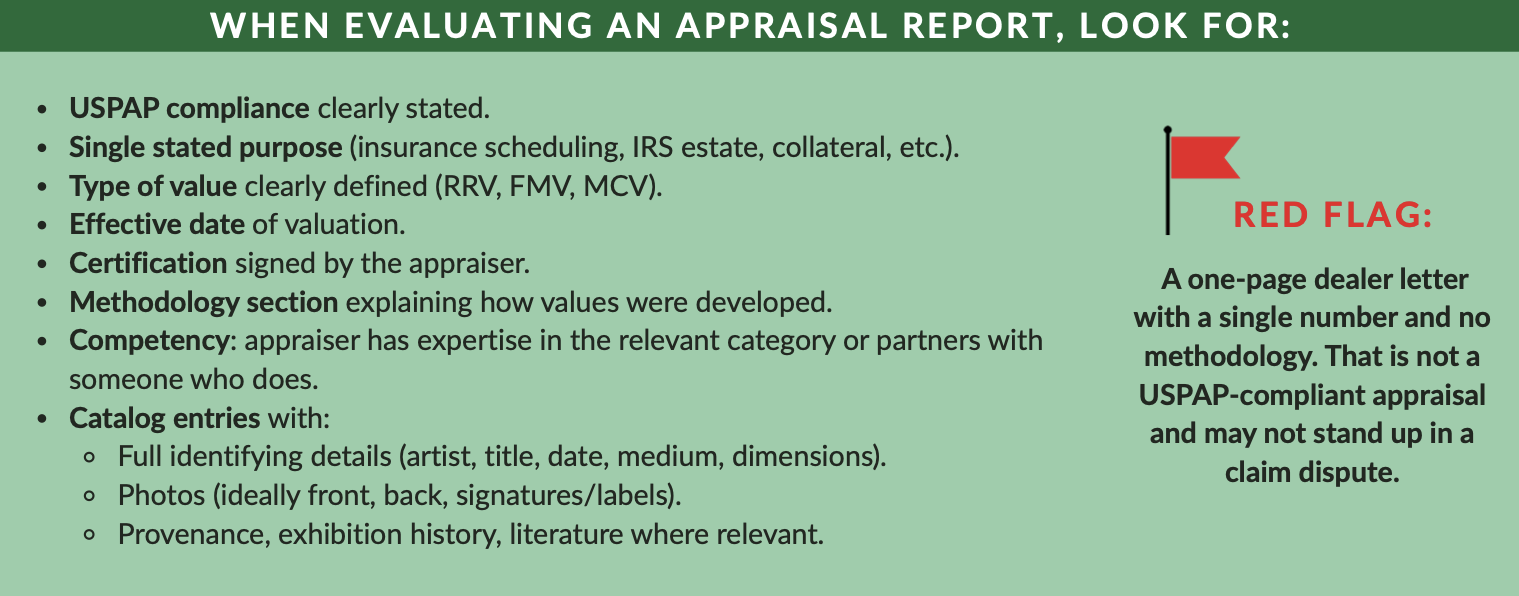

Recommendations in this Watchlist include the following, concerning what to look for in an appraisal report and when works of fine art should be reappraised for insurance purposes.

Chubb Art Market Update

It was a pleasure and honor to give the 2025 H1 Art Market Update talk to Chubb’s Fine Art team last week. Thank you to Laura Doyle for extending the invitation, which provided an opportunity to reflect just before the fall auction season opens in New York this week.

By many measures, the art market continued to contract significantly in 2024 (e.g., auction totals down 25%, and off by 39% for $10M+ lots), and has remained soft on the whole in 2025, and yet the total picture has been much more complex than this.

Year-to-year comparisons of totals at equivalent auctions are not fully determinative with regard to the health of a market, nor can demand necessarily be wholly assessed given the circumstantial nature of supply, whether from estates or otherwise.

Strong sales in supply-challenged markets such as Old Masters have shown strength when exemplary works have become available (e.g., Canaletto), and we have seen surges in many markets, not least Surrealism (most visibly, Magritte and Carrington), key female artists in various sectors (e.g., Dumas record), and historically undervalued collecting categories such as South Asian postwar and contemporary art, as well as the personal property markets adjacent to art such as Design and collectibles, in which a series of extraordinary records have been set.

As the consignments for November are just being announced, including those at a level not seen in the first half of the year (esp. Klimt), we can begin to forecast what the fall might look like relative to the spring.

Artsy quote: Inflation and the Art Market

My comments are included in Veena McCoole’s article in Artsy, “How Inflation Impacts the Art Market”:

“Prices may be up, but if money coming in is also up, that doesn’t necessarily mean a downturn in art purchasing for some,” noted art advisor David Shapiro. “People in the market for a Pablo Picasso, perhaps, aren’t as swayed by inflation and day-to-day costs.”

Reginald Marsh, Art Auction, ca. 1940

(l.) George Condo, The Redhead, 2024, acrylic and pastel on paper, 78 × 60 inches; (r.) George Condo, Abstract Male Portrait, 2024, acrylic, pastel, and metallic paint on paper, 80 × 78 inches (both at Hauser & Wirth)

The market for pastels, George Condo and otherwise

In an Artnet News article published on Friday, Katya Kazakina writes about the market for George Condo’s pastels, which are the subject of two concurrent solo shows in New York, at Hauser & Wirth in SoHo, and at Sprüth Magers on the Upper East Side.

As Kazakina reports, the pastels, all variably large in scale, are priced between $600,000 - $1.5 million, mostly at $1.2 million, and are “selling fast.” Kazakina muses: “Was it savvy to focus on works on paper?… Are they a good deal? Will they prove to be good investments?”

She notes, perhaps with a subtext of her now-familiar bearishness that “Condo’s best result for a resold work on paper at auction was for Tan Orgy Improvisation (2005) [illustrated below], which made just over $1 million in 2018.”

While this is true, rather than reach back over six years, one will find a more relevant comparable in the recent sale of a smaller but stylistically closer work, Abstract Face (2) (illustrated below), which fetched $516,600 at Christie’s, New York just over a year ago, on November 10, 2023; the price flew above a high estimate of $350,000. Abstract Face (2) lacks the rich color backgrounds seen in the works presently on view at Hauser & Wirth and Sprüth Magers, and as such, the strong realized price for such a less complex piece further suggests that the current primary-market prices may be a “good deal” and that the works might in fact be re-sold for a profit in a future secondary market.

(l.) George Condo, Tan Orgy Improvisation, 2005, acrylic, oilstick, and pastel on paper, 60.4 x 61.75 inches; (r.) George Condo, Abstract Face (2), 2012, pastel on paper, 30 x 22.5 inches

The works currently on view at Hauser & Wirth and Sprüth Magers are mixed media, with acrylic and pastel. This combination of media can be seen in many Condo works, including Force Field (2010) (illustrated below), which set his auction record, selling for $6,857,413 at Christie’s, Hong Kong (online) on July 10, 2020, at the height of the pandemic. The essential difference in materials between that work and those presently on view at Hauser & Wirth and Sprüth Magers is the support: Force Field is on linen, not on paper like the works currently on view.

(l.) George Condo, Force Field, 2010, acrylic, charcoal, and pastel on linen, 45.6 x 82 inches; (r.) George Condo, Female Gathering, 2024, Acrylic, pastel and metallic paint on paper, 80 x 78 inches

Among drawing media, pastel is frequently regarded as among the most similar to paint, with its pure powdered pigment and minimal binder giving a vibrancy seen in few drawing media. Historically, pastels have sometimes been called “pastel paintings” — without a bit of wet paint.

For some artists, like Nicolas Party (or Rosalba Carriera and others, long before), pastel is the main medium — their painting medium, one might even say. Party’s highest auction sales, by far, are for pastels (though on linen), topped by the sale of Blue Sunset (2018) for $6,667,293 on November 30, 2022, then Still Life (2015) for $4,990,125 on May 28, 2023, both at Christie’s, Hong Kong (both illustrated below).

(l.) Nicolas Party, Blue Sunset, 2018, pastel on linen, 70.9 × 59.1 inches; (r.) Nicolas Party, Still Life, 2015, pastel on linen, 59 × 70.9 inches

When one wonders about the long-term market viability of pastels on paper made by artists who also make oil/acrylic paintings on canvas/linen, one might do best to look further back in time to artists who made both pastels and paintings.

The most compelling example might be Edgar Degas, whose all-time auction record for a two-dimensional work is in fact for a gouache/pastel on paper, Danseuse au repos (ca. 1879) (illustrated below), which sold for $37 million at Sotheby’s, New York on November 3, 2008. [NB: One Degas sculpture has sold for a higher price at auction.]

In fact, the seven highest auction sales of two-dimensional Degas works are works on paper, made partially or wholly with pastel. If a major Degas oil painting were to be offered for sale, it could of course realize a strong price, but to date, the highest realized auction price for a Degas oil is $13.6 million, i.e., slightly over one third the highest realized auction price for a Degas pastel / gouache.

Another such example is Mary Cassatt, whose auction record is also for a mixed-media work on paper that includes pastel. This is Young Lady in a Loge Gazing to Right (ca. 1878-79), which sold for $7,489,000 at Christie's, New York on October 20, 2022, significantly above the high estimate of $5 million, and also above the auction record of $6.2 million for a Cassatt oil painting on canvas.

(l.) Edgar Degas, Danseuse au repos, ca. 1879, gouache and pastel on paper, 23.25 × 25.25 inches; (r.) Mary Cassatt, Young Lady in a Loge Gazing to Right, ca. 1878/79, pastel, gouache, watercolor, and charcoal with metallic paint on paper, 25.25 × 19.9 inches

AXA XL: Underwriting Case Study Series

This week I had the pleasure and honor to present a 2024 art market recap to underwriters at AXA XL Insurance.

Finishing 2024, statistics of decline could be seen everywhere, particularly when comparing overall year-to-year sales totals (i.e., 2024 with 2023 and especially 2022), and yet the overall picture is a more nuanced one. Broadly speaking, my presentation complicated the overarching correction narratives that have prevailed in the press.

Fluctuations in supply, particularly at the highest end, often depend on circumstantial factors such as the availability of major estates. As such, any comparison to 2022 will be skewed by the Paul Allen auction (especially) and the Ammann sale.

The failure of any lot to sell at auction for over $50 million in the first half of 2024 did look paltry given the offerings in the immediate past, but in the second half of the year, the three highest lots at auction totaled $255.4 million, over double the total of the three highest lots sold in the first half of the year.

The price realized for the Magritte alone ($121.6 million) was similar to the total of the prices realized for the three highest lots sold during the first half of the year, and the fact that it sold for over $25 million more than a confident estimate (with guarantee) suggests that present demand is strong in the market for highest-end masterpieces, when in fact there is supply.

As such, when Zachary Small asked in a doom-and-gloom article on November 2, 2023, whether the art market “will need to discount its masterpieces,” the answer seems to be a resounding, “NO” – at least not at the high end of the markets.

In 2024, collectors chased high-end non-art masterpieces as well, such as the stegosaurus skeleton, Dorothy’s ruby slippers, and Babe Ruth’s “called shot” jersey, which respectively shattered auction records for fossils, movie memorabilia, and sports memorabilia, collectively underscoring the expansive cross-sector outlook of the trophy market at present.

Other markets, however, were indeed cooler. The middle market remained artist-specific, with a continued trend toward selectivity for some artists. And in 2024, the market for many emerging artists fully collapsed, following a moment of rapid speculation-oriented growth in the covid period.

Also addressed in my 2024 market recap were notable developments such as:

The reuturn of the acceptance of cryptocurrency as payment for auction lots, by Sotheby’s for Cattelan’s Comedian.

The seismic security breach that took place in May when Christie’s website was hacked, making it inoperable during the marquee sale week.

Sotheby’s overhaul and subsequent reversal (less than a year later) of their fee structure, both for buyers and for sellers. The implications of this are also covered in my recent contribution for Artnews.