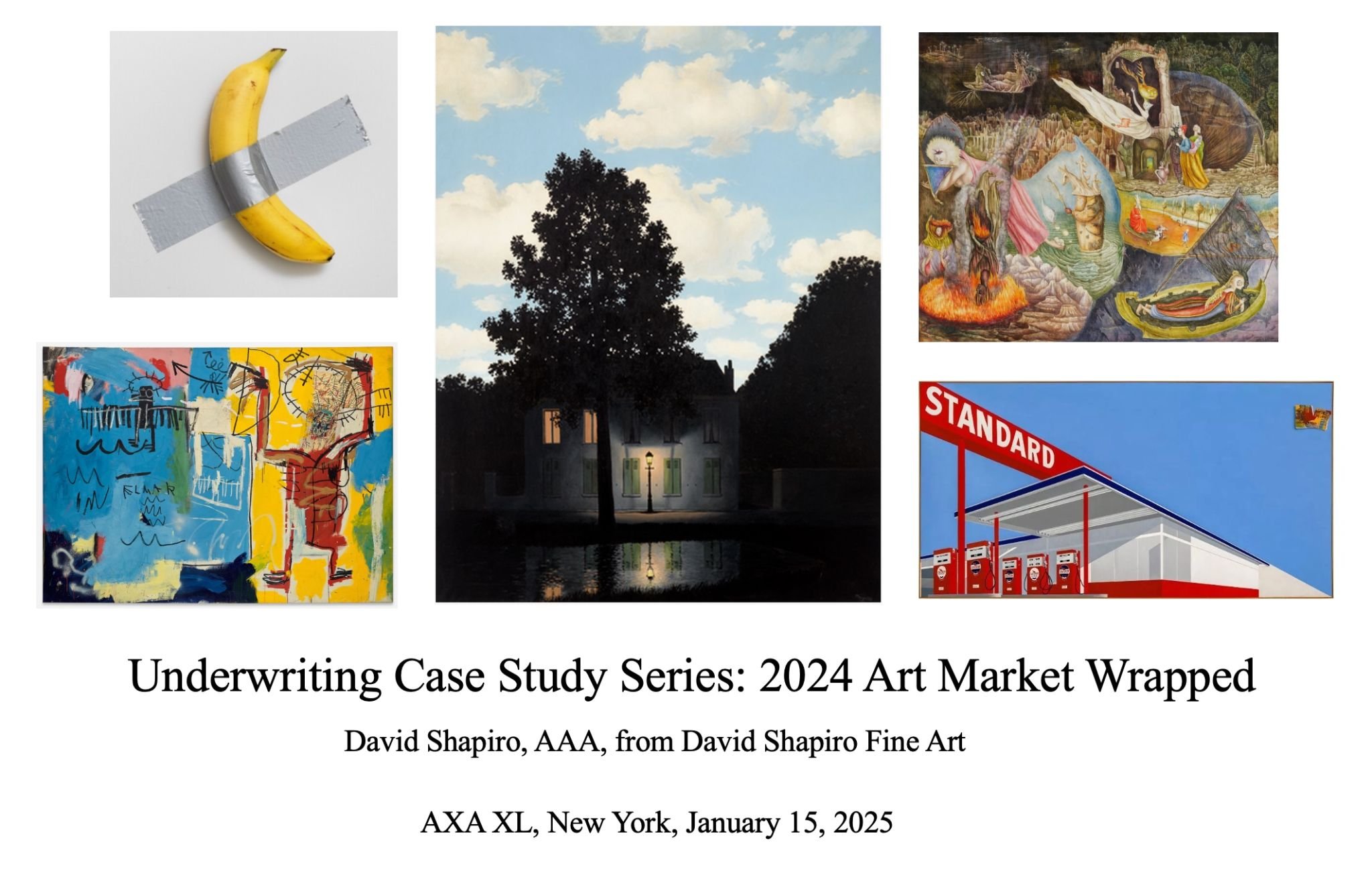

In his January 2025 market recap in the Art Newspaper, Scott Reyburn called René Magritte’s L’empire des lumières, which sold for $121.6 million at Christie’s, the “one out-and-out masterpiece on offer in New York” in the November sales. Reyburn’s comment might be correct if his words were to be edited a bit: The Magritte was the one out-and-out masterpiece in the stratospheric market for highest-end trophies.

But the concept of a masterpiece should be understood as something that is exceptional within its own context. On the same date that the Magritte sold for $121.6 million, by far an all-time record for the artist, a record was also shattered at Christie’s for a Magritte work on paper (of the same title and subject as the painting); which fetched $18.8 million, over double its high estimate. This too could be considered a masterpiece within the context of his works on paper. On the same date, the second highest price for a Magritte work on paper was realized as well.

Sales such as these complicate the narrative of decline that many art market writers have used as a journalistic framework – and such press may even serve a self-fulfilling prophecy, scaring both prospective sellers and prospective buyers, as I have witnessed firsthand.

Without question there has been contraction in some markets in the past two years (e.g., as for many emerging artists), but in a truly recessionary period (or “slump” in Reyburn’s words), sales such as these simply would not be taking place.

One has to wonder, furthermore, what Reyburn has in mind when he says of the $121.6 million Magritte:

“[G]iven that this world-famous image was billed by the auction house as the greatest Surrealist painting to have ever appeared on the auction market, should it have made more?”

The Magritte sold for a price far higher than that of any Surrealist painting at auction or, to the best of my knowledge, any marketplace. It is hard to imagine how much more the painting could have realized on another date – and what that date might have been, given the obvious present taste for Surrealism, which could also be seen in the record-shattering top two sales of Leonora Carrington at Sotheby’s in 2024, including Les Distractions de Dagobert (1945), which made over $28 million in May.