It was a pleasure and honor to give the 2025 H1 Art Market Update talk to Chubb’s Fine Art team last week. Thank you to Laura Doyle for extending the invitation, which provided an opportunity to reflect just before the fall auction season opens in New York this week.

By many measures, the art market continued to contract significantly in 2024 (e.g., auction totals down 25%, and off by 39% for $10M+ lots), and has remained soft on the whole in 2025, and yet the total picture has been much more complex than this.

Year-to-year comparisons of totals at equivalent auctions are not fully determinative with regard to the health of a market, nor can demand necessarily be wholly assessed given the circumstantial nature of supply, whether from estates or otherwise.

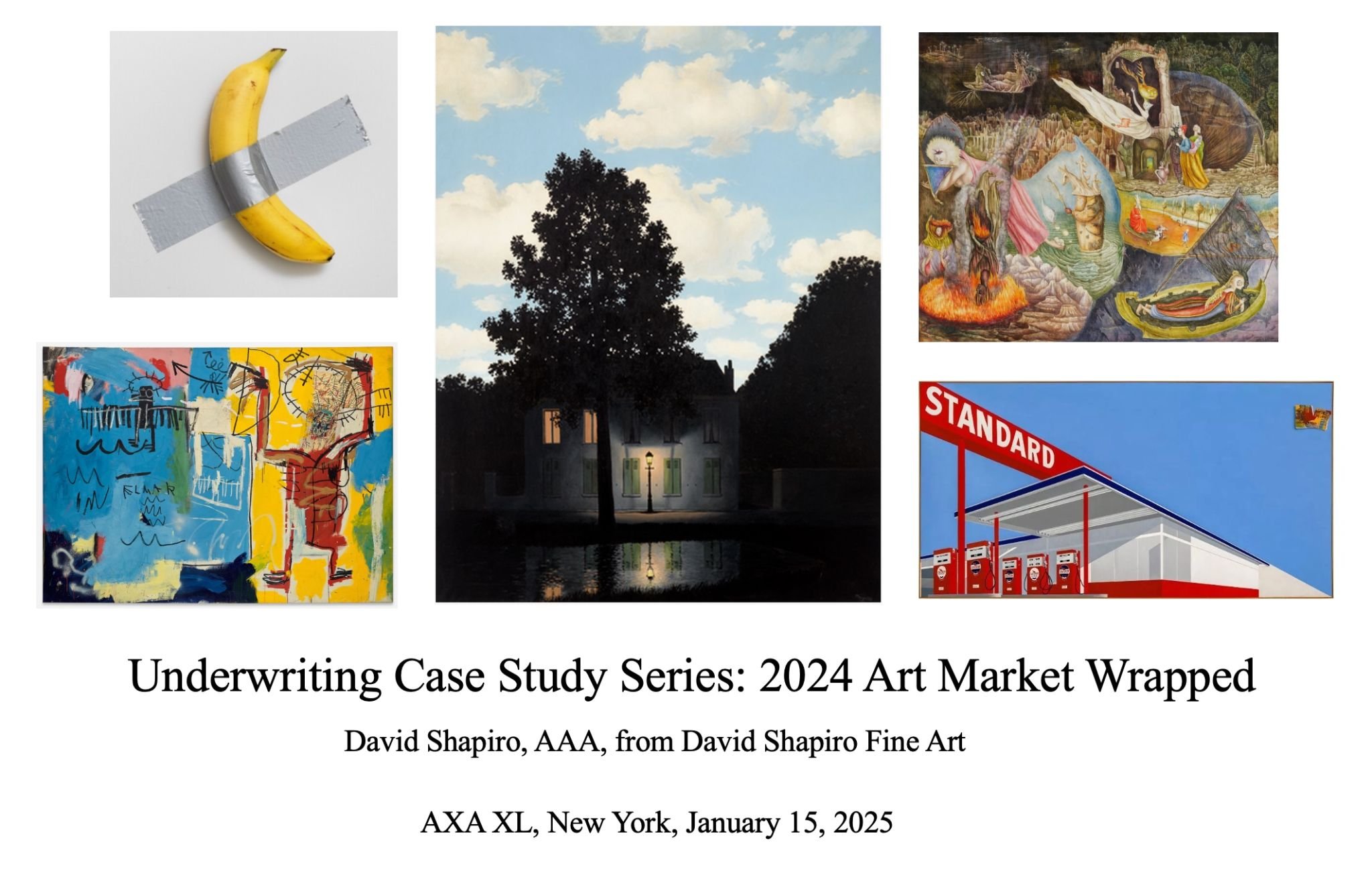

Strong sales in supply-challenged markets such as Old Masters have shown strength when exemplary works have become available (e.g., Canaletto), and we have seen surges in many markets, not least Surrealism (most visibly, Magritte and Carrington), key female artists in various sectors (e.g., Dumas record), and historically undervalued collecting categories such as South Asian postwar and contemporary art, as well as the personal property markets adjacent to art such as Design and collectibles, in which a series of extraordinary records have been set.

As the consignments for November are just being announced, including those at a level not seen in the first half of the year (esp. Klimt), we can begin to forecast what the fall might look like relative to the spring.